The 2025 Digital Fundraising Benchmark Report for Hospitals, produced by Digital Health Strategies in partnership with the Association for Healthcare Philanthropy, is the industry’s leading digital survey. Our insights and benchmarks are drawn from survey responses and data from non-profit hospital foundations.

This year’s benchmarks were compiled using fundraising performance data from a participant pool of 43 hospitals across the country. This participant pool is different from last year’s. As a result, comparisons between this year’s benchmarks and previous editions should be avoided, as variations in the participant pool may impact the data’s comparability.

The data used was validated and standardized by Digital Health Strategies and only includes revenue from email, website and direct mail solicitation campaigns. Revenue from events, major giving, planned giving or employee giving is not included.

Use this report to validate and improve your hospital’s digital fundraising strategy. Our insights are based on the experience and performance of hospitals across the country. They can help you acquire and convert more donors, generate larger gifts, retain donors longer, and identify and cultivate promising major donors.

Top 4 Fundraising Priorities for

Hospitals + Health Systems

Major Donor Development: Foundations heavily reliant on major gifts

60% of foundations reporting revenue increases YOY cited major gifts as their primary source of revenue.

Organizations with stable or declining YOY revenue were more likely to rank planned giving and grants as significant sources of revenue.

Enhanced use of AI and machine learning linked to growth

Foundations reporting revenue growth were more than twice as likely to be using AI and machine learning for fundraising communications, data analytics & models, and donor research than those who reported revenue decreases.

Mid-level giving is key to revenue growth

Almost twice as many foundations that saw revenue growth YOY reported having a distinct program for mid-level donors vs those that had no current strategy for mid-level giving.

Donor Pipeline: Digital channels are fueling growth

Half of foundations reporting revenue increases year over year have a digital grateful patient program in place, vs only 1/3 of those without one.

Key Findings

MAJOR DONOR DEVELOPMENT

Revenue growth tied to staffing and technology alignment on larger gifts.

- Major gifts are a top revenue source for most respondents, but 34% of survey respondents ranked mid-level giving as their second most important source of revenue, an increase from 2024 when mid-level was tied for second place with Grants.

- Proportion of $10k+ gifts increased 14% YOY, continuing the multi-year trend of growth in larger gifts.

- The foundations reporting revenue increases were those that had larger gift officer teams (6 or more), were retooling their shops with more applied uses of AI and machine learning (6 or more), and achieving greater satisfaction with their marketing and fundraising tools (71%).

RETENTION + UPGRADES

Leveraging digital communications to increase upgrade rate among retained donors an opportunity for foundations to offset softer acquisition.

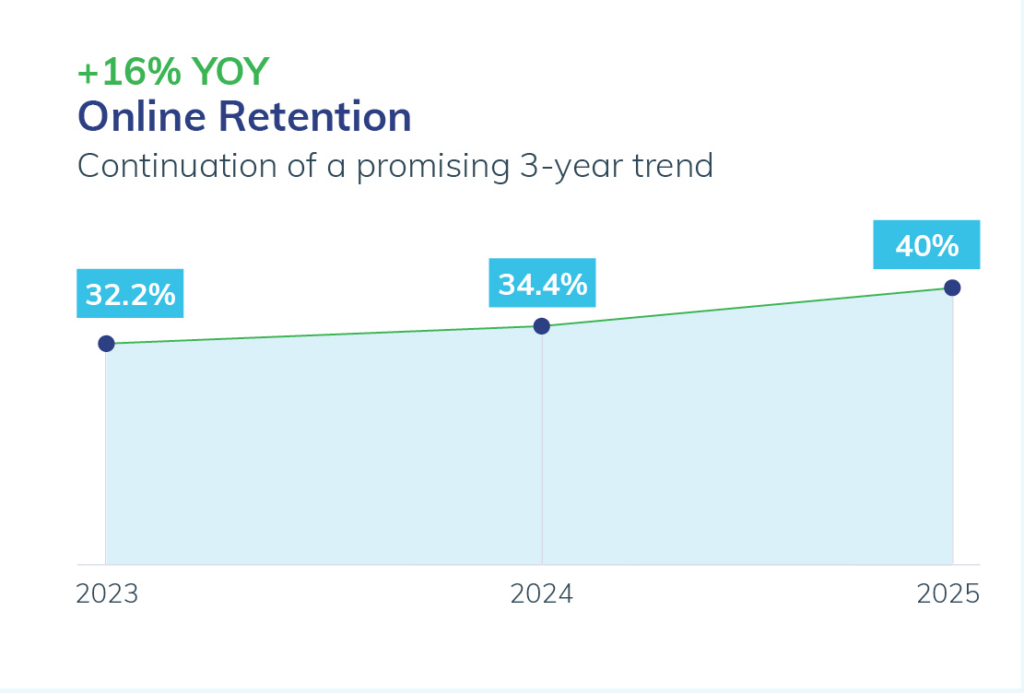

- Online donor retention increased 16% YOY to 40%, the continuation of a promising multi-year donor loyalty trend.

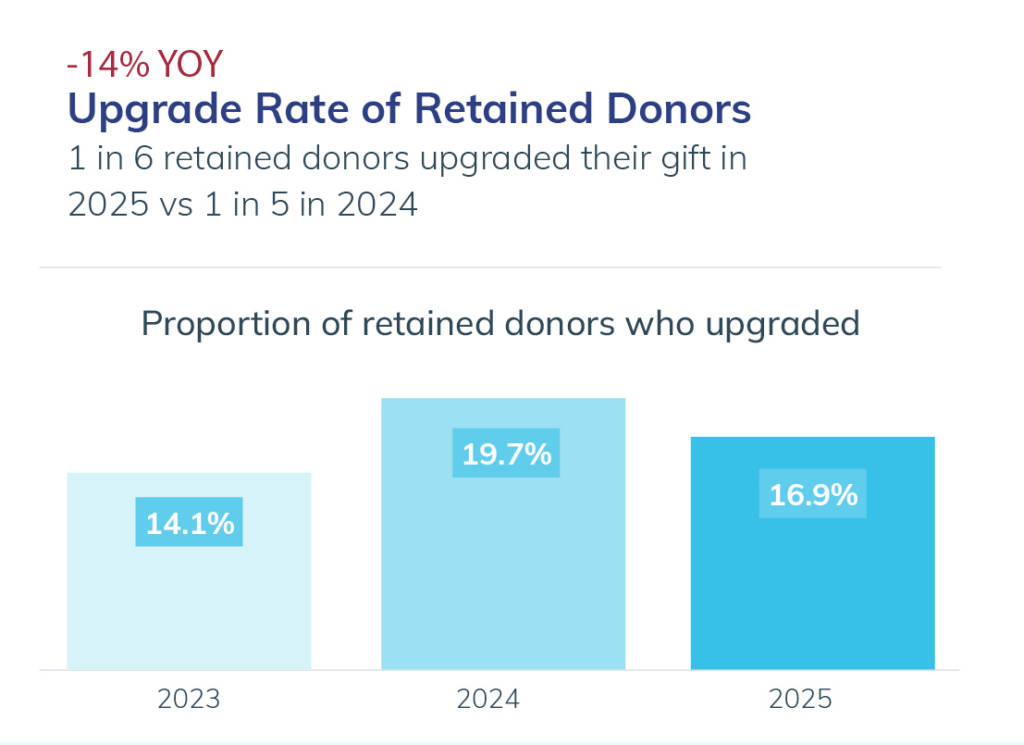

- 17% of retained donors upgraded their gift in 2025 versus 20% in 2024, revealing an opportunity to enhance donor lifetime value with personalized upgrade asks.

- 67% of foundations sending more emails year over year reported revenue increases, suggesting digital communications to loyal audiences are playing a vital role in donor retention and foundation revenue, given declining acquisition.

DONOR PIPELINE

Invest in digital channels to drive new donor growth.

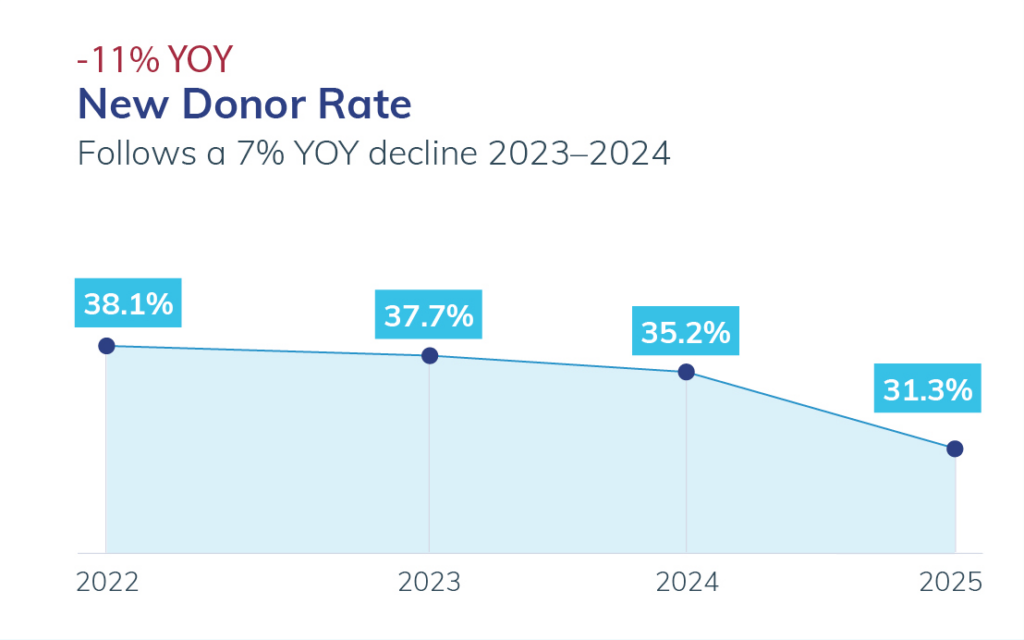

- New donor acquisition is down 11% YOY, with new online donors comprising 15% of online donors, down from 17% in 2024.

- With 59% of foundations reporting that their new donor volume either declined or remained the same, digital grateful patient programs can make the difference. Almost 50% of foundations with a digital grateful patient program in place reported increases in new donors.

- New donor gift value is plateauing. 71% of survey respondents reported that the average first online gift value either remained the same or declined year over year. But 82% of foundations reporting increases in new donor gift value also reported using AI or machine learning, the majority of those for data analytics and writing tasks, suggesting acquisition opportunities for machine-assisted audience selection and personalization.

Hospital Foundation Digital Fundraising Benchmarks

We sourced quantitative data from 43 hospitals across the country to develop specific hospital fundraising benchmarks around donor acquisition, donor retention, and major donor development.

Want to benchmark your program? Drop us a line at contact@digitalhealthstrategies.com

Full survey results

1. How many employees does your foundation have?

2. How many front-line fundraisers are on your team?

3. What is your average gift officer portfolio size? (The number of donors and prospects in each gift officer’s portfolio).

4. What is your approximate total revenue (gifts and commitments) over the last 12 months?

5. What was your total online revenue for the past 12 months?

6. Over the next 12 months, what are the top 3 priorities for your organization?

7. Over the past 12 months, our online revenue has…?

8. Over the past 12 months, our average first online gift amount has…?

9. Over the past 12 months, our number of online new donors has…?

10. Over the past 12 months, our number of online gifts over $1k has…?

11. How integrated are your annual and major giving programs?

12. Which are the most common channels through which you communicate with donors and prospects?

13. Compared to last year, the volume of emails we’ve sent per constituent has…?

14. Compared to last year, the volume of direct mail we’ve sent per constituent has…?

15. Which of the following messaging tactics do you frequently use in your donor communications?

16. How is your organization responding to the implications and impacts of HR1 (OBBBA) on eligibility criteria for Medicaid and Medicare in your donor and non-donor communications?

17. Which of the following best describes your organizational philosophy towards mid-level donors?

18. When communicating with mid-level donors, do you include them in annual fund solicitations (i.e. email and direct mail efforts)?

19. How does your organization currently manage mid-level donors (e.g. donors that give $1,000 – $9,999 annually)?

20. What challenges does your organization face in managing mid-level donors?

21. Which tools do you use to identify high-value prospects (mid-, major and planned giving)

22. Please rate how well your major giving tools are supporting your organizational goals.

23. Which CRM do you use to manage donor information?

24. Which online donation platform do you use?

25. Which email marketing platform do you use for donor communications?

26. Which uses of AI and machine learning are you using in your fundraising program?

27. Do you have a digital grateful patient program in place?

28. If you have a grateful patient program (digital or direct mail) in place, where do you store your non-donor patient audiences?

29. How well do you feel your Marketing and Fundraising technology tools are supporting your organizational goals?

30. What’s the biggest challenge with your fundraising technology toolset?

Methodology and Participants

Survey Participants

This survey was sent to members of the Association for Healthcare Philanthropy. The results from that survey, compiled with data from the work of Digital Health Strategies, were used to develop this report. Survey responses from 118 participants from the United States are included in this report. These organizations span from small, community-based hospitals, to large inter-state hospital networks.*

*3% answered I don’t know to the below.

Geographic presence of survey participants

communities serving a principal city

of a metropolitan area

communities serving within a metropolitan

or micropolitan area

communities outside of a

metropolitan area

Survey Participants: System Size

hospitals <100 beds

hospitals 100-499 beds

hospitals 500+ beds

Benchmarking Participants

Benchmarks were developed from data sourced from 43 hospitals and hospital systems to develop specific hospital fundraising benchmarks around donor acquisition, retention, and lifetime value. The data used was validated and standardized by Digital Health Strategies and only includes revenue from e-mail, website, and direct mail solicitation campaigns. Revenue from events, major giving, planned giving or employee giving is not included. All participants are based in the United States. The participating organizations span from small, community-based hospitals, to large inter-state hospital networks.

Get Ready for 2026

Use this checklist to support your fundraising strategy and planning.

MID- AND MAJOR DONOR DEVELOPMENT

- Review portfolios in advance of year-end campaigns and include uncontacted and select major giving prospects in year-end communications.

- Acquire donors at midlevel in 2026. Leverage giving capacity data to create acquisition audience lists. Develop differentiated communications that invite them to support the work of your foundation with a mid-level contribution.

LEVERAGE AI AND MACHINE LEARNING

- Leverage AI to accelerate personalization of year-end communications, to dynamically tailor subject lines, body copy, and ask arrays to increase engagement and drive revenue.

- Move beyond basic wealth and RFM scoring in 2026 and find tools and partners that can model gratitude and clinical engagement to identify truly qualified prospects and donors.

DONOR UPGRADES AND RETENTION

- Optimize digital journeys at year-end to ensure user experience for repeat donors (checkout speed, saved payments, mobile) is as frictionless as possible.

- Show your most loyal donors that you know (and value) them in 2026: Develop targeted custom retention and upgrade communication journeys that leverage capacity and past giving data to highlight opportunities and impact in areas they are interested in.

- Remember how donors responded during the last major health crisis? Only 20% of systems are currently or plan to talk about the implications of HR1 (OBBBA) for Medicare and Medicaid in donor communications.

Contact us

Want to learn more? Drop us a line to talk directly to someone from our team.

Contact Us